Are you earning enough interest? Part 2: Fixed Income in Vogue

Fixed income, the often forgotten segment in investor portfolios, is now back in vogue.

In Part 2 of our two-part blog series on answering 'Are you earning enough interest?', we examine 1) Why fixed income is forgotten, 2) Why fixed income demands attention today, and 3) Factors to consider when creating a fixed income portfolio in today's environment.

First, what is fixed income?

When we think about the investment landscape, it typically boils down to two major asset classes:

1. Stocks which represent ownership in a company, and

2. Fixed income which represents investment in debt

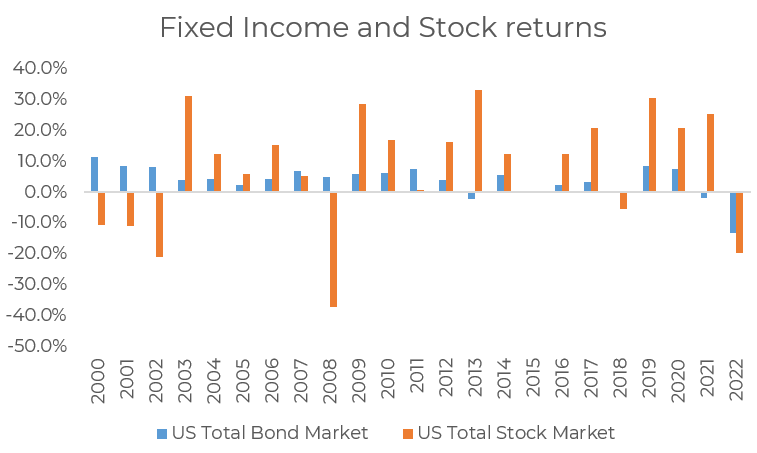

Source: Portfolio Visualizer. Bloomberg US Agg Float Adjusted Index, CRSP US Total Market Index

Stocks have historically generated higher returns, but with increased risk: if the company does well, investors benefit (and vice versa if the company fails). See 2008 and 2013 for examples of these extremes in the chart above.

Fixed income returns on the other hand, have been relatively stable. As an investor in the issuer’s debt, fixed income provides interest payments. Issuers can range from governments (U.S, state/local, international) to corporations (Apple, Ford, etc) with varying risks based on the issuers credit rating. Investing in riskier issuers can provide higher returns, but with higher risk that the issuer defaults on the loan.

While fixed income historically generated lower returns versus that of stocks, it’s an important stabilizer and diversifier versus a 100% stock portfolio. In constructing a portfolio, clients should consider a mix of both stocks and bonds that is catered to their 1) risk tolerance, 2) goals, and 3) time horizon.

Why fixed income is forgotten

Since 2008, average fixed income returns of 2.4%/year have been muted vs. historical returns dating back to 1987 of 5.2%/year. This is attributable to a multitude of factors, ranging from loose Fed policy and low inflation. Additionally, fixed income famously recorded the worst performance on record of -13% in 2022 as interest rates rose sharply to the highest level in 15 years. [1,2].

Note: Fixed income investments typically decline in value when market interest rates rise. This makes sense since the bond you own is now less attractive than higher interest paying bonds out there. This dynamic is called duration, and longer-dated bonds are typically more sensitive to rate changes versus shorter-dated bonds.

3 reasons why investors need to examine their fixed income portfolio today

Source: St. Louis Federal Reserve

Higher income: Yields on 2-year and 10-year US government bonds are currently 4-5% and 3-4% respectively [3]. This compares to yields of just 0.1% and 1.4% in 2021, so investors are earning much higher rates today. Further, as mentioned in part 1 of this blog, investors looking to stash short-term cash can earn close to 5% annualized returns on US Treasury Bills.

Recession insulation: Fixed income typically insulates investors during stock sell-offs. Additionally, higher coupons provide a better cushion in the case of a recession, which could be looming in the near term.

Attractive risk vs. reward versus stocks: In financial geek terms, a term called the ‘equity risk premium’ (ERP) measures the extra return investors are earning in stocks vs. bonds (if stocks return 7% and bonds return 3%, the ERP is 4%). Since stocks are inherently riskier, the ERP is typically positive, and a higher ERP % indicate stocks are attractive relative to bonds. That spread, however, is at its lowest since 2007[4], which means bonds are looking attractive versus stocks today. Said another way, stock investors are not compensated for the level of risk relative to bonds, or fixed income.

What factors should I consider for my fixed income portfolio today?

Overall, investors should consider a diversified, multi-asset approach when building fixed-income portfolios that can perform well across different economic environments. Factors to consider:

Shorten duration: When facing a rising-rate environment, investors should consider limiting—but not eliminating—duration, or sensitivity to interest rate changes in their fixed income portfolios.

Municipals: For investors in higher tax brackets, municipal bond exposure can benefit since income is federal tax free, and sometimes state tax free. This can drive material net-of-tax value creation for investors, but should be evaluated by a financial and tax professional.

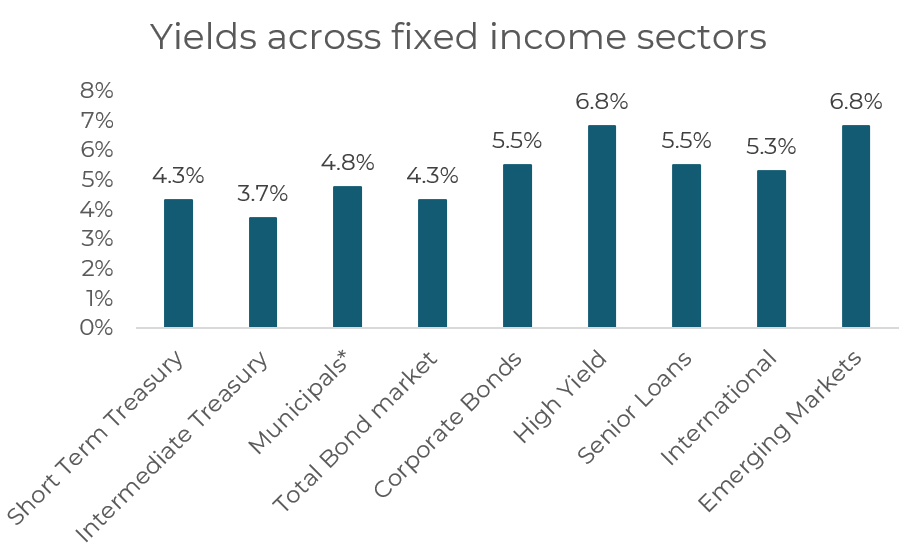

Diversify beyond the index: Many investors have positions that just mimic the Bloomberg Aggregate index, a widely followed fixed income benchmark. For investors looking to diversify further and take on risk for potentially higher yields, there are different sectors investors can explore as shown in the chart below[5]:

Source: Vanguard, Invesco, iShares. Represents yield to maturity as of March 2023. *Municipals assumes estimated after tax yields for an investor in the 37% marginal tax rate

Summary: Fixed income, though simple in concept, can be a complex asset class to optimize and manage. At Ballaster, we have comprehensive investment management experience to navigate wealth compounding opportunities and risks across fixed income sectors.

References

[1] As measured by the Bloomberg US Agg Float Adjusted Total Return index. Historical average since 1987.

[2] CNBC, ‘2022 Was The Worst Year Ever For US Bonds’. January 2023.

[3] St. Louis Fed, as of March 1, 2023. Rates and returns subject to change.

[4] Sofi, Refinitiv

[5] Yield to maturity on VFISX,VFITX,VTEB,BND,LQD,VWEHX,BKLN,BNDX,VWOB, as of March 1, 2023.

Disclaimer: The article is for informational purposes only and is not intended to be used as a general guide to investing or financial planning, or as a source of any specific recommendations, and makes no implied or express recommendations concerning the manner in which any individual’s investments or assets should or would be handled, as appropriate strategies depend upon each individual’s specific objectives. Opinions expressed in this article are current opinions, which are not reliable as fact, as of the date appearing in this article only and are subject to change. For a comprehensive review of your personal situation, please consult with a financial or tax advisor. Ballaster clients and/or Ballaster employees may own securities mentioned in this blog