Unlocking Key Tax Strategies for the OBBBA Bill

The One Big Beautiful Bill Act (OBBBA) enacts tax law changes that can profoundly impact your financial planning, offering significant savings but also introducing new complexities. In this blog, we summarize key changes and strategies to consider to maximize opportunities.

Proactive planning is essential to take full advantage of enhanced deductions and credits and to avoid common pitfalls like deduction limitations and phase-outs. Please note the below is meant to be a summary of the new tax bill. For the full version please reference the link here and consult a tax and/or financial advisor for guidance tailored to your specific needs.

CORE TAX CHANGES

TAX CUTS AND JOBS ACT (TCJA) MADE PERMANENT

Tax Brackets: The seven existing tax brackets (10% to 37%) are now permanent. Without OBBBA, the top rate would have reverted to 39.6%.

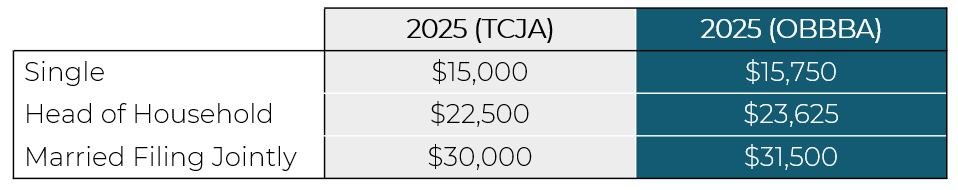

Standard Deduction (2025): Modest increase from prior TCJA rules as follows:

Takeaway: Most taxpayers will continue to benefit from high standard deductions and lower effective rates, with potentially more dollars taxed at 10% and 12% rates starting in 2026 given an extra inflation adjustment in those brackets

SALT DEDUCTION CAP INCREASE

From 2025 to 2029, the State and Local Tax (SALT) deduction cap increases to $40,000 ($20,000 for Married Filing Single, or MFS) and decreases to a $10,000 cap ($5k for MFS) above phase-out income limits

Phase-out begins at $500,000 ($250,000 MFS) Modified Adjusted Gross Income, or MAGI, and fully phases out at $600,000 ($300,000 MFS).

After 2029, the cap reverts to $10,000

Source: Kitces.com

Takeaway: Itemized taxpayers in high-tax states may benefit, but high earners should carefully monitor income thresholds to avoid phase-outs that will reduce the SALT cap. Note that income phase outs are the same for single and married filing jointly (MFJ), thereby introducing a ‘marriage penalty’ for tax purposes

ITEMIZED DEDUCTION LIMIT FOR HIGH EARNERS

In 2026, for those in the 37% bracket itemized deductions are capped at a tax benefit equivalent to the 35% tax rate

Takeaway: High-income taxpayers should consider accelerating deductions into 2025 to avoid the 2% haircut

ENHANCED SENIOR DEDUCTION

From 2025–2028, filers aged 65+ can claim an additional $6,000 deduction ($12,000 for couples) [1]

Does not require itemizing deductions, but does not reduce Adjusted Gross Income (AGI) for social security taxation and Medicare premium calculations

Phases out above $75,000 MAGI ($150,000 for joint filers)

Takeaway: Seniors should consider the impact on taxable income, especially regarding Roth conversions

Tax Changes for Families

ENHANCED CHILD TAX CREDIT

Starting in 2025, the Child Tax Credit increases from $2,000 to $2,200 per eligible child in 2025. The credit phases out at $50 for each $1,000 of income above threshold limits ($200k-$243k MAGI for single / $400k-$443k MAGI for married filing jointly)

Takeaway: While it won't completely offset major costs such as daycare (or diapers!) those with children get a slightly larger tax break, though families should monitor phase-out income thresholds

“MAGA” SAVINGS ACCOUNTS

Who gets what?

A $1,000 seed deposit from the U.S. government for children born between Jan 1, 2025 – Dec 31, 2028, provided they’re U.S. citizens with SSNs

Parents, employers, and others can contribute a combined total of up to $5,000 per year to a MAGA account until the child turns 18. Additional contributions from Government and Charitable organizations do not count towards the $5,000 limit.

Account growth: Funds are invested in low-cost U.S. equity index funds (≤ 0.1% fees) and grow tax-deferred — no taxes on gains until withdrawal

Withdrawals & Tax Treatment

Before Age 18: Generally not allowed

Age 18–24: May access up to 50% of the account for qualified expenses (education, job training, first-home purchase, small business). Qualified withdrawals are taxed at long-term capital gains rates (0/15/20%)

Age 25–29: Full access to entire account balance only for qualified uses, taxed as capital gains

After age 30: Remaining funds become fully accessible. Qualifying withdrawals taxed at capital gains; non-qualified withdrawals are taxed as ordinary income plus a 10% penalty

Unused funds after age 31 are forced distributed and taxed as ordinary income [2,3]

Contribution taxation rules

Parent-funded contributions: Post-tax, so original principal withdrawals are tax-free; gains are taxed upon distribution

Employer contributions: Not taxed on deposit but treated as taxable income on withdrawal, even for qualified uses

Takeaway: MAGA accounts offer a free $1K starter, tax-deferred growth, and capital-gains tax on qualified withdrawals—but come with strict age and usage rules, potential penalties, and ordinary income tax on non-qualified uses. Compare versus 529 plans and IRAs for education and/or retirement goals

EXPANDED 529 EXPENSES

Starting in 2025[4], 529 plan qualified expenses are expanded to include certain credentialing, post-secondary testing fees, and continuing education requirements. Additionally, for K–12 students qualified 529 expenses now include (beyond tuition):

Books

Supplies

Online learning materials

Tutoring fees

Starting in 2026, the annual aggregate withdrawal limit for K–12 expenses increases from $10,000 to $20,000 per child, per year. The new $20,000 cap includes both tuition and the expanded list of non-tuition qualified expenses (books, supplies, online courses, and tutoring fees).

Takeaway: Families may want to consider increasing 529 contributions to account for expanded qualified expenses and higher contribution limits

Tax Changes for Environmental and Transportation

ELIMINATION OF GREEN ENERGY TAX BREAKS

Electric Vehicle tax credits expire after September 30, 2025

Home energy efficiency credits expire after December 31, 2025 [7]

Takeaway: Complete qualifying purchases and improvements before deadlines to claim credits

Source: Kitces.com

NEW CAR LOAN INTEREST DEDUCTION

From 2025–2028, the OBBBA provides up to $10,000 deduction for interest on new, U.S.-assembled vehicle loans

The deduction is reduced by 20 cents for each $1 of income above $200,000 MAGI (joint filers) and $100,000 (others)

Takeaway: Note that new cars bought via financing before 2024 cannot be refinanced in 2025 to qualify for the interest deduction

Tax Changes for Charitable Donors

CHARITABLE DEDUCTIONS

Starting in 2026:

Non-itemizers can deduct up to $1,000 ($2,000 for MFJ)

Donations must be in cash

Cannot be used to establish or maintain a donor advised fund

Itemizers face a 0.5% of AGI reduction for allowable deductions. This means for itemizing filers with $100k of income, 0.5%, or $500 of income is non-deductible

Takeaway: For non-itemizers taking the standard deduction, consider pushing donations to 2026. For itemizers, consider bunching donations in 2025 to maximize deductions before the new 0.5% floor limitations take effect

EDUCATION SCHOLARSHIP CREDIT

Starting in 2027, a federal tax credit of up to $1,700 is available for donations made to state-approved scholarship-granting organizations (SGOs) [5]

Takeaway: Monitor state participation and approved organizations to leverage this credit, which is more valuable than taking a deduction for charitable donations given credits are a 1:1 reduction of your tax bill

Tax Changes for Business and Real Estate

DEDUCTIONS FOR BUSINESS AND REAL ESTATE OWNERS

Qualified Business Income Deduction (QBI): QBI was made permanent with wider phase-out thresholds ($75k for single, $150k for married filers) for eligible pass-through entities. Starting in 2026, OBBBA provides a minimum $400 deduction for those with at least $1,000 in QBI

Pass Through Entity Taxes (PTET) Workaround: Preserved, allowing pass-through entities to deduct state taxes at the entity level. This effectively bypasses the individual State and Local Tax (SALT) deduction cap for many pass-through owners

New Incentives for Qualified Opportunity Funds (QOF): Gains sold to buy a QOF after Dec. 31, 2026 is deferred for up to 5 years. QOF’s held > 5 years receive 10% basis step up on deferred gain (investments in rural areas receive 30% step up), while QOF’s held > 10 years receive 100% exclusion of post-acquisition gain

Bonus Depreciation: 100% first-year bonus depreciation reinstated for qualified property placed in service from Jan 20, 2025

What is bonus depreciation? Bonus depreciation allows businesses to deduct the full cost of certain assets in the year they buy them instead of spreading that depreciation deduction over several years

Qualified property includes tangible personal property with a recovery period of 20 years or less such as computers, vehicles, machinery/equipment, furniture, and certain land improvements (fences, landscaping, pavers, etc.)[6]

Takeaway: More business owners may be able to claim the QBI deduction given higher phase-out thresholds and minimum deduction. Those with rental property may also benefit when upgrading their home with applicable improvements. Note that investors with existing QOFs will not defer gain further than Dec. 31, 2026

QUALIFIED SMALL BUSINESS STOCK ELIGIBILITY EXPANDED

The OBBBA significantly expands the tax benefits of Qualified Small Business Stock (QSBS). For QSBS issued after July 4, 2025:

More businesses qualify: The bill raises the asset limit for businesses to qualify for QSBS from $50 million to $75 million

Maximum gain exclusion increased to $15m (or 10x basis, whichever is greater) vs. $10m prior

Tiered exclusion % based on holding period (vs. prior 5 year holding minimum rule)

Takeaway: Investors and business owners should evaluate QSBS given the OBBBA expanded eligibility requirements. QSBS stock acquired before July 4, 2025 adheres to prior rules. Note that certain states opted to NOT conform to the above federal rules

Tax Changes for Stock Compensation an High Net Worth Filers

AMT EXEMPTION PHASE-OUTS REDUCED

The Alternative Minimum Tax (AMT) exemption amounts remain at the TCJA levels of $88,100 for single and head of household filers, and $137,000 for married filing jointly (MFJ) filers

However, the income thresholds at which these exemptions begin to phase out are lowered to $500,000 (S/HOH) and $1,000,000 (MFJ) of AMT income, significantly earlier than under previous law

The exemption phaseout rate increases from 25% to 50% of AMT income above the threshold amounts, meaning a faster reduction in exemption amounts as income rises

Additionally, the state and local tax deduction (SALT) is added back to taxable income for AMT calculation, eliminating the benefit of the temporarily expanded SALT deduction under regular tax rules

Takeway: More filers may see AMT due to exemptions phasing out more aggressively. High earners with material Incentive Stock Options (ISO's), should reconsider exercise timing to minimize AMT liability

ESTATE AND GIFT TAX EXEMPTIONS INCREASE

Starting 2026, the federal lifetime estate and gift tax exemption is permanently set at $15 million per person, indexed for inflation thereafter. For married couples, this effectively doubles to $30 million due to the portability of exemptions between spouses

Takeaway: The increased exemption provides more certainty for estate planning and allows more wealth to be transferred tax-free, eliminating the prior scheduled reduction to about $7 million per person

PARTNER WITH BALLASTER TO MAXIMIZE YOUR TAX PLANNING OPPORTUNITIES

By partnering with Ballaster, you receive a tailored analysis of your financial situation and tax return designed to maximize your tax planning opportunities. With a clear understanding of your complete financial picture, we can identify and optimize deductions and strategies to help you keep more of your wealth. We’d love to meet you for a complimentary consultation meeting- please click here for more details

SOURCES

[1] IRS, 'One Big Beautiful Bill Act: Tax deductions for working Americans and seniors'

[2] WSJ, 'How the $1,000 Trump Accounts Would Compare to Other Savings Plans

[3] Kiplinger, 'The GOP Wants to Auto-Enroll Your Child in a 'Trump Account' for Savings'

[4] my529, 'Federal Changes to Qualified Education Expenses'

[5] Edchoice.org, 'Congress Enacts First-Ever Federal Tax Credit for Education Scholarships

[6] Taxfyle, 'Bonus Depreciation for Real Estate Owners'

[7] IRS, 'Energy Efficient Home Improvement Credit'